Fiscal year 2023

This is another year of challenges for the business world. Further slowdown was visible in many sectors due to the still uncertain socio-economic situation. This market environment requires consistent cost discipline from companies. Of course, this does not mean that we have given up on investment. Our development on both domestic and foreign markets has allowed us to continue solidly supplying the domestic economy. The total amount of taxes and other contributions paid by LPP reached a record result. How did we do it?

In 2023, we implemented further new solutions to improve our operations, especially in the field of IT and logistics. We placed, among others: on m-commerce, strengthening the development potential of our brands in the online channel.

For LPP it was also a time of development in Southern and Western Europe. We have opened further stores of our brands in Great Britain. We also made our debut in the capital of fashion – Milan. Exports continued to be a strong branch of the company’s income. Its scale also allowed us to further promote Polish creativity internationally. However, we still remembered our roots and contributed to our national budget.

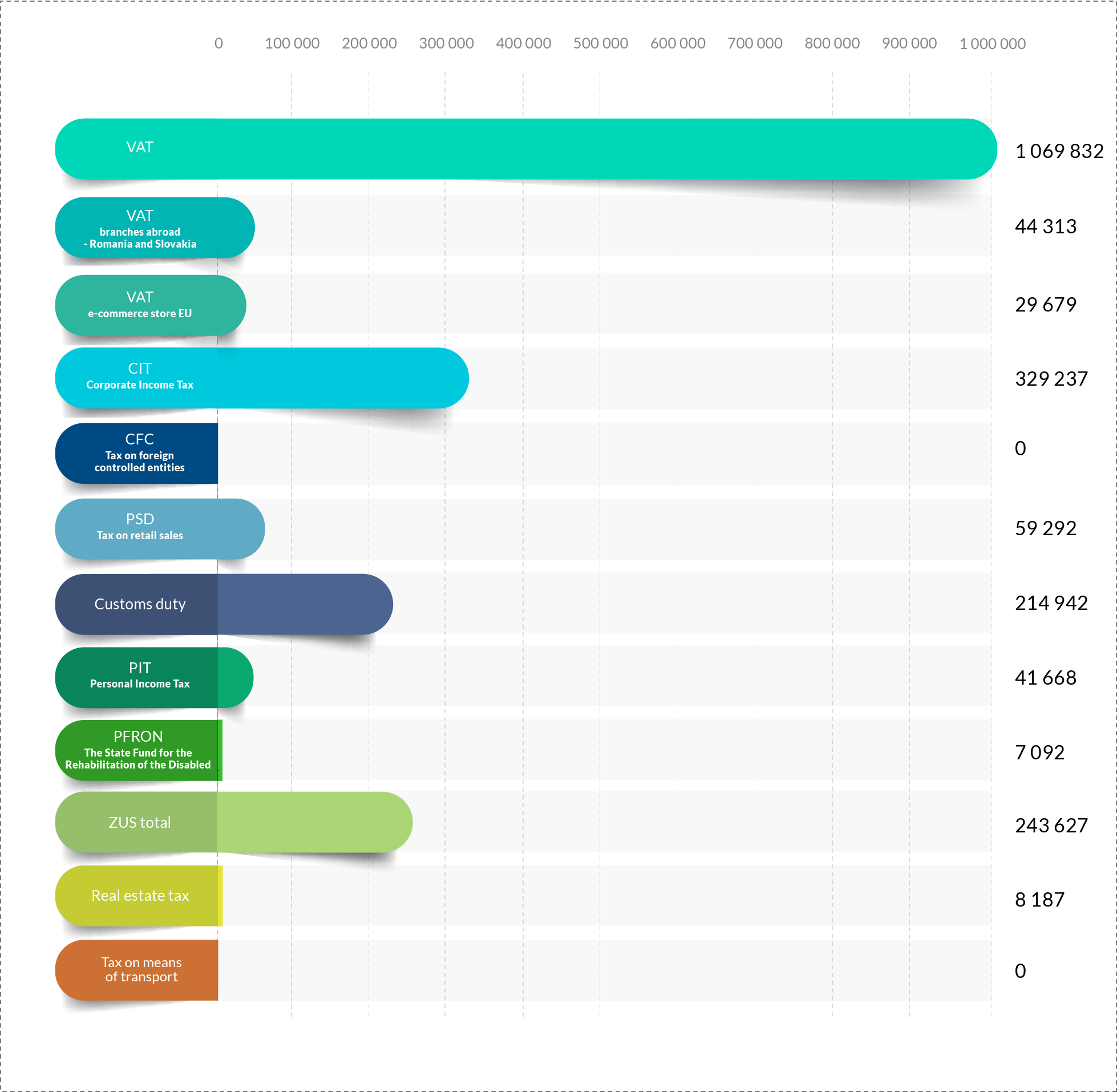

The table below presents taxes and other levies paid by LPP – the data refer to the 2023 financial year.

Taxes paid to the state budget in 2023

Fiscal year |

2023 |

|---|---|

VAT |

1 069 832 |

VAT branches abroad Romania and Slovakia |

44 313 |

VAT e-commerce store EU

|

29 679 |

Corporate Income Tax – CIT |

329 237 |

CFC tax on foreign controlled entities |

0 |

Tax on retail sales PSD |

59 292 |

Customs duty |

214 942 |

Personal Income Tax – PIT |

41 668 |

The State Fund for the Rehabilitation of the Disabled (PFRON) |

7 092 |

ZUS total |

243 627 |

Real estate tax |

8 187 |

Tax on means of transport |

0 |

Total [PLN thousand] |

2 047 869 |

The figures for 2023 are projected. Final figures will be provided in July 2024 after the tax return is filed.

Analysis of data

The total amount that our company contributed to the national treasury in 2023 was 20% higher than the result from 2022. It thus reached a record level. The taxes and fees paid by LPP resulting from all other liabilities towards the national treasury amounted to almost PLN 2.1 billion.

Over PLN 1.1 billion of this amount was VAT – this is the largest component of the total sum. The second place was taken by corporate income tax – CIT, which amounted to PLN 330,329 million.

Other important items in the structure of revenues to the state budget were: ZUS (almost PLN 250,244 million) and customs duties (almost PLN 215 million) paid by LPP. The retail sales tax amounted to almost PLN 60 million.

A new item for the company in the list of its contributions to the national budget was VAT related to the operation of branches in Romania and Slovakia – it amounted to almost PLN 45 million. LPP paid slightly less, almost PLN 42 million, in personal income tax – PIT. Further in the structure of sums paid by the company to the Polish treasury were: VAT from e-commerce stores in the European Union (almost PLN 30 million), real estate tax (over PLN 8 million) and PFRON (over PLN 7 million).

Taxes paid to the state budget in 2023 (in thousands PLN).