Fiscal year 2024

The past year has marked a period when our family-owned company based in Gdansk saw growth on an unprecedented scale, though not without its challenges.

The LPP Group recorded a remarkable sales growth of over 20% (in constant currencies), with the dynamic expansion of our Sinsay brand, which saw a spectacular revenue increase of nearly +47% in constant currencies in 2024, with more than 600 new shops opening within just twelve months.

These are only some of the achievements that contributed to a record-breaking amount of taxes and levies paid by the LPP Group into the national treasury for the 2024 fiscal year.

Throughout the year, we remained focused on developing our distribution network, expanding it by more than 50%.

January 2024 saw the launch of our first overseas distribution centre in Romania, followed by its expansion just a few months later.

We also strengthened the potential of our e-commerce warehouses by opening two additional fulfilment centres: one in Poland, the other in Romania. We also embarked on the expansion of our distribution centre in Brześć Kujawski.

Our international expansion concentrated primarily on Central and Southern Europe, where we capitalised on the relatively low saturation of retail networks in smaller towns and cities.

At the same time, we remained consistent in pursuing our omnichannel strategy, allowing us to expand both our onsite shops and our online presence.

In 2024, we significantly broadened our online product offerings across all our brands and continued to enhance our mobile applications.

Those efforts resulted in a significant contribution to the national economy.

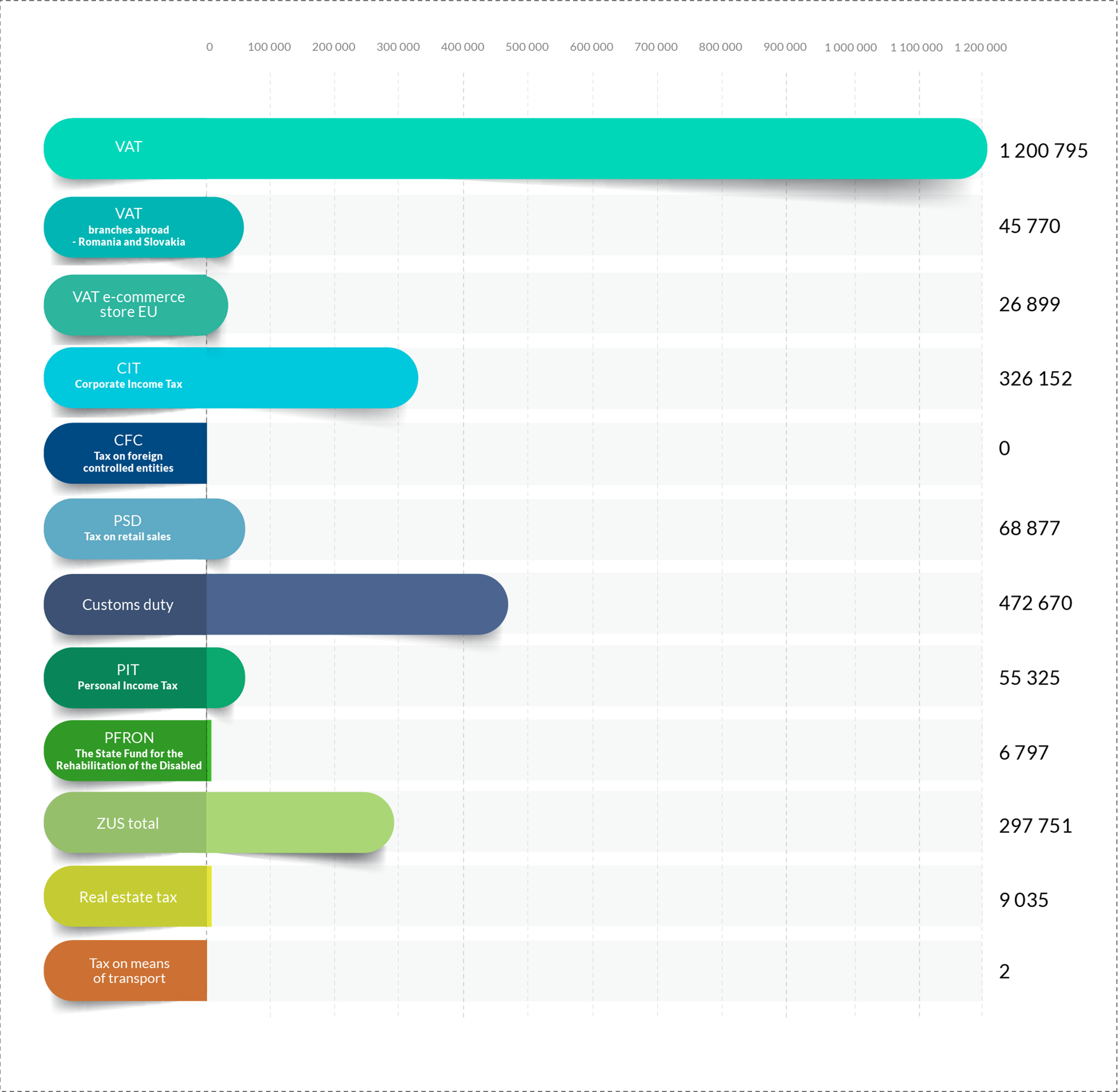

The table below presents a detailed breakdown of the taxes and other levies paid by LPP for the 2024 financial year.

The figures for 2024 are based on forecasts. The final figures will be published in July 2025, following the submission of our tax returns.

Taxes paid to the state budget in 2024

Fiscal year |

2024 |

|---|---|

VAT |

1 200 795 |

VAT branches abroad Romania and Slovakia |

45 770 |

VAT e-commerce store EU |

26 899 |

Corporate Income Tax – CIT |

326 152 |

CFC tax on foreign controlled entities |

0 |

Tax on retail sales PSD |

68 877 |

Customs duty |

472 670 |

Personal Income Tax – PIT |

55 325 |

The State Fund for the Rehabilitation of the Disabled (PFRON) |

6 797 |

ZUS total |

297 751 |

Real estate tax |

9 035 |

Tax on means of transport |

2 |

Total [PLN thousand] |

2 510 073 |

The data for 2024 is forecast. The final values will be provided in July 2025 after the tax return is filed.

Analysis of data

The total value of the taxes paid by LPP into the Polish state budget for the 2024 financial year reached the highest level in the company’s history, exceeding the 2023 figure by over PLN 131 million.

In total, LPP contributed more than PLN 2.5 billion to the Polish economy through taxes and levies resulting from other obligations.

As in previous years, the largest component was VAT, in excess of PLN 1.2 billion.

This was followed by customs duties, totalling over PLN 472 million, and corporate income tax, amounting to more than PLN 326 million in the period under consideration.

Other significant contributions from LPP to the Polish treasury were as follows: social security contributions (over PLN 297 million), retail sales tax (nearly PLN 69 million), personal income tax (over PLN 55 million), VAT from foreign branches – Romania and Slovenia (nearly PLN 46 million) and EU e-commerce VAT (nearly PLN 27 million).

Further components in the structure of contributions from LPP to the Polish budget were real estate tax (approximately PLN 9 million), State Fund for the Rehabilitation of Persons with Disabilities (nearly PLN 7 million) and tax on means of transport (PLN 2 thousand).

Taxes paid to the state budget in 2024 (in thousands PLN).