Fiscal year 2021

Due to the ongoing pandemic, the past year was associated with a significant economic slowdown in Poland and in the world. It was caused, inter alia, by the introduced restrictions, which largely affected the service and trade industry. Nevertheless, our family company from Gdańsk made every effort to end this year with a good result and guarantee stable employment for its employees.

Appropriate business decisions, flexibility as well as quick and skilful adaptation to changing and, above all, difficult economic conditions allowed us to continue to successfully implement the development strategy of LPP. All this translated into our profits, and thus into a significant amount of taxes, which we transferred to the state budget. LPP is a Polish clothing company in which, despite continuous expansion and dynamic development, we remember our roots – that’s why we pay taxes in Poland.

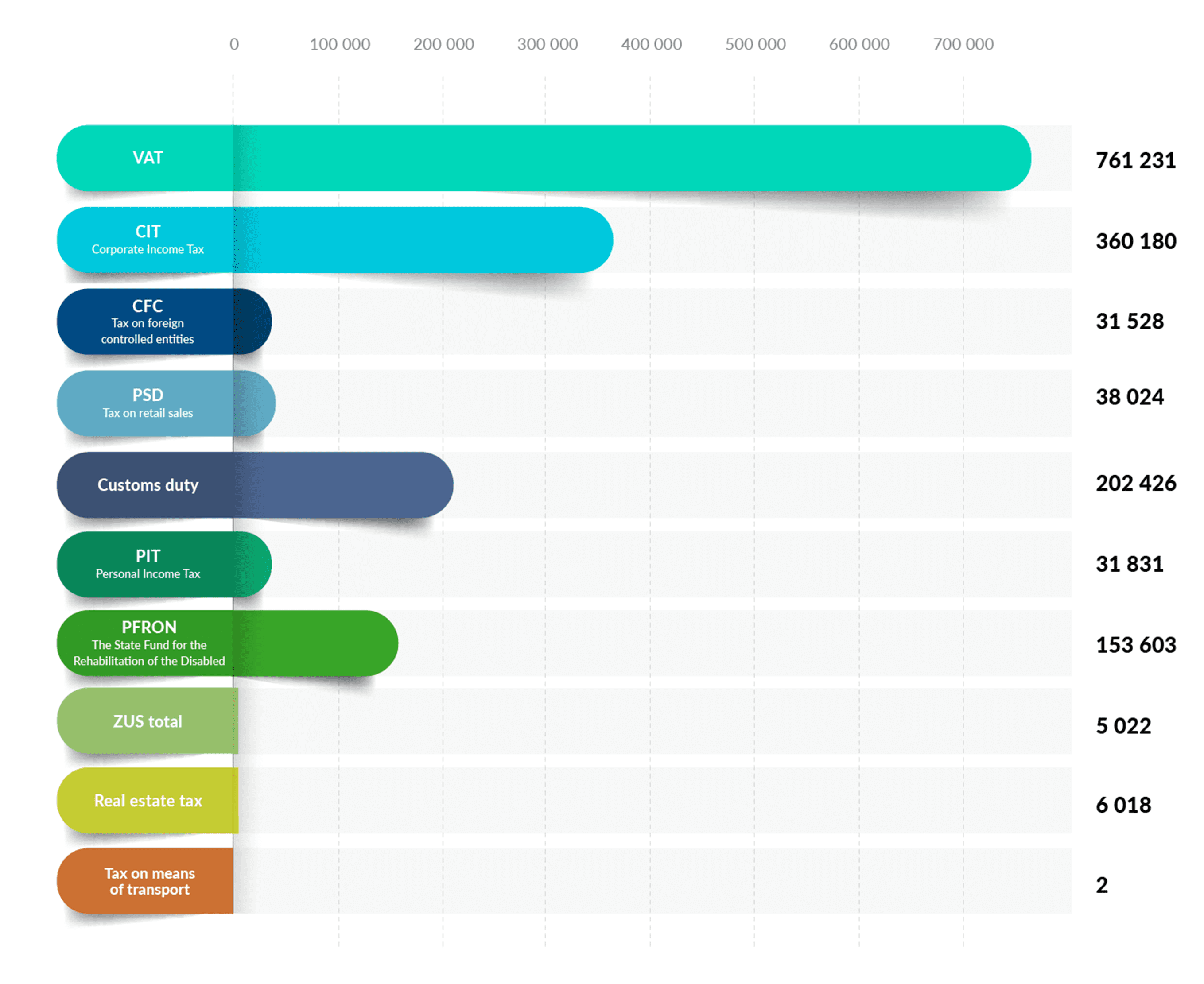

The table below presents information on what taxes LPP paid to the Polish budget for 2021/22. It includes not only the total amount of LPP taxes – the whole has been divided in a transparent and legible way so that everyone can see the details about the amount of our individual liabilities.

The table takes into account the amounts relating to the 2021/22 financial year, i.e. for the period from 02.2021 to 01.2022.

Taxes paid to the state budget in 2021

Fiscal year |

2021 |

|---|---|

VAT |

761,231 |

Corporate Income Tax – CIT |

360,180 |

CFC tax on foreign controlled entities |

31,528 |

Tax on retail sales PSD |

38,024 |

Customs duty |

202,426 |

Personal Income Tax – PIT |

31,831 |

The State Fund for the Rehabilitation of the Disabled (PFRON) |

5,022 |

ZUS total |

153,603 |

Real estate tax |

6,018 |

Tax on means of transport |

2 |

Total [PLN thousand] |

1,589,865 |

Data for 2021 are forecast. Final figures will be announced in July 2022 after filing the tax return.

Data analysis

The total amount of LPP tax revenues to the Polish budget in the accounting year 2021/22 amounted to over PLN 1.5 billion. This amount consists of various types of taxes and levies and any other liabilities that we have transferred to the national budget.

The VAT tax paid by LPP was the highest liability for this period and amounted to over PLN 761 million. Another important component of all revenues from our family clothing company to the state budget was the CIT tax, which exceeded PLN 360 million, and the customs duty, which amounted to over PLN 202 million.

In the described tax period, LPP also provided the state treasury with over PLN 5 million as part of ZUS contributions. The CFC tax exceeded PLN 31 million, and the PSD retail sales tax was over PLN 38 million.

LPP also paid large sums to the state treasury due to personal income tax (PIT – over PLN 31 million) and property taxes (over PLN 6 million).

Taxes paid to the state budget in 2021 (in PLN thousand)